Business License Tax

Most businesses located within Chesterfield County are subject to the Chesterfield County business license tax. Rates are based on the business classification.

This is a tax on the privilege of engaging in a licensable business activity within the county, and it is calculated upon gross receipts (or gross purchases in the case of wholesale merchants).

New businesses must obtain all required licenses prior to beginning business in the county, and a late payment penalty of up to 10% of the tax due will be imposed along with interest if the licenses are not obtained within 30 days of the date the business opened.

For existing businesses, renewal applications and appropriate tax payments must be filed in the Commissioner’s Office or postmarked on or before March 1 each year to avoid the late payment penalty and interest.

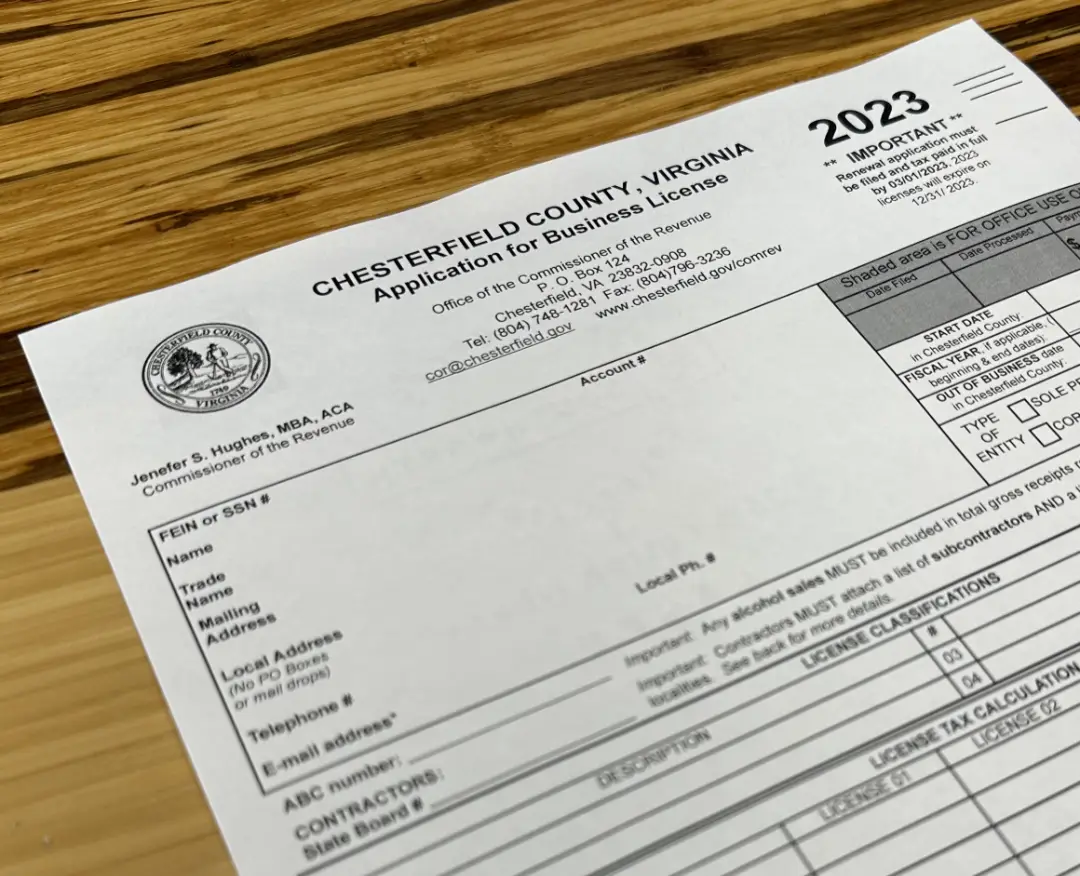

Business License Application

Current business license forms and applications may be downloaded from the Commissioner of the Revenue website.

For assistance with a business license application or the licensing process, please contact the Commissioner of the Revenue Office at (804) 748-1281.